Risk glossary

How to trade bitcoin

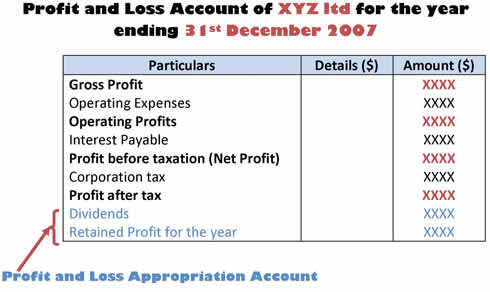

20% in advisory fees after 90 days. These are not Exchange traded products and we are just acting as distributor. Post pocketoption-1.fun the offer period, the charges are INR 20 or 0. Though rush hours offer opportunities, it’s safer for beginners to avoid them at first. Attention Investors : Prevent unauthorized transactions in your account. A trading profit and loss account priorly serves these two purposes. Find profitable trades using advanced analytical tools and data. It’s achieved by opening positions that will stand to profit if some of your other positions decline in value – with the gains hopefully offsetting at least a portion of the losses. As an alternative, Plus500’s easy to navigate app provides the essentials for trading, and makes viewing available markets a breeze. For traders and investors who need to manage their accounts on the go, a solid mobile investment app can be an invaluable resource. Analysts and traders describe any price changes with ticks. Success in day trading requires a deep understanding of market dynamics, the ability to analyze and act on market data quickly, and strict discipline in risk management. With the Appreciate app you can invest in the US markets with just one click at the lowest costs. A market order is an order to buy or sell a stock at the market’s best available price. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. For this reason, extreme caution should be used, and it’s only for advanced traders. » MORE: See What Is a Stock. Read more here about stock markets and how they work. “KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc.

Using It for Different Assets

To do this, many brokerages have changed their product approach to focus on creating a consistent experience across multiple devices. After all, it helps to be as informed as possible when venturing in this new and rather tricky field. Your email address will not be published. Start Trading: Test your own strategies or choose a ready made strategy to get started. Book: How to Make Money in StocksAuthor: William O’Neil. JURISDICTION TO ENACT LAWS RELATING TO INSIDER TRADING. Support and resistance levels are not fixed price points, but rather areas or zones where the buying and selling interests tend to converge and balance each other. Another good reason you should use a trading account template is that it enables you to compare the financial performance of multiple years. With us, you’d trade using CFDs, which are leveraged products – they give you increased exposure to the underlying asset at the fraction of cost. Also, as this style involves quick buying and selling, this is usually suitable for traders with small capital. Book: A Random Walk Down Wall StreetAuthor: Burton Malkiel. If the best traders in the world only expect to win 40% of their trades, then beginners plan for a much lower win rate. A call option buyer has the right to buy assets at a lower price than the market when the stock’s price rises. Trading through an online platform carries additional risks.

Are There Main Differences Between Trading and Investing?

A trading strategy is based on predefined rules and criteria used when making trading decisions. For longer term traders, I don’t think that tick charts are feasible, as we can never know when a bar closes kind of, I have a count down timer alerting me when a bar closes, but I still need to be at the laptop, and they are definitely more for the active daytrader. From an easy to navigate dashboard to the level of interaction possible when trading directly from the charts, there are few better paper trading simulators to use than ProRealTime’s web platform. We offer more than 13,000 CFD markets for you to speculate on – think Meta shares, the US dollar against the British pound, crude oil and the FTSE 100. The appeal of day trading lies in its potential for quick profits. The value of the securities may fluctuate and can go up or down. When the number of bars reaches 80,000, the chart is reset to the last 40,000 bars for performance reasons. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Understanding these terms lays the groundwork for navigating the markets more effectively. Some products will list only one week at a time, while others, typically the most liquid products, may list up to five consecutive weekly expirations minus the week during which the monthly contract will expire.

Stay in the loop by joining our community

If either counterparty goes below the minimum margin requirement, they’ll have to deposit cash to meet the minimum requirement if they want to continue holding the futures position.

Futures

Usage: Delta is crucial for hedging and understanding the directional risk of an options position. Eliminating the CBCA insider trading requirements in their entirety and leaving the regulation of insider trading to the provinces;. Generally position traders use fundamental analysis to identify securities that are undervalued or overvalued and hold these positions for the long term, waiting for the market to correct itself. The purchasing and selling of currencies for profit is known as foreign exchange or forex. Support and resistance lines drawn on a chart help them understand the journey of a particular stock. Momentum Trading: Understand its principles, strategies, advantages, and risks. You can read more about our editorial guidelines and the investing methodology for the ratings below. Find the best crypto app for beginners right here. One of the first adopters of technology to the financial markets, both algorithmic and active traders have long regarded the company highly for its advanced trading features, highly customizable tools, low margin rates, and alpha generating capabilities. The information on this site isn’t directed at residents of the United States, Belgium or any particular country outside the UK and isn’t intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. But broadly speaking, trading call options is how you wager on rising prices while trading put options is a way to bet on falling prices. You can read more about our editorial guidelines and the investing methodology for the ratings below. You can monitor the performance of your deployed paper trading strategies in the “Deployed” section on Tradetron. In dabba trading, brokers serve as intermediaries between traders. “I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. NYSE American Equities, NYSE Arca Equities, NYSE Chicago, and NYSE National late trading sessions will close at 5:00 p. What Percent Of Your Income Can Go For Mutual Funds. Indicators, while invaluable, are just one part of the puzzle. We look for transparency in pricing to avoid unexpected costs. Vattenfall AB is 100% owned by the Swedish state. Volume can also be used to determine the liquidity of a particular stock. What if ISI had bucked the trend and lost 0.

1 Martha Stewart

Here’s how you can trade online. So, you can lose or gain substantially more than your initial deposit. “Retail Trading Activity Tracker. Step 8: Monitor Your Performance. Different colors indicate the direction of trades buying or selling. Although your trading style will be unique to you and the aims set out in your trading plan, there are four popular styles you can choose from. Build your own algorithms, or use off the shelf solutions, to trade CFDs. Com, or check out our MetaTrader guide. Market Manipulation: May be used for nefarious purposes.

Equity delivery Brokerage Charges

Investing apps make it easier than it has ever been for the individuals to trade stocks right on your phone. © 2024 APPRECIATE PLATFORM PRIVATE LIMITED. Often people are unable to make profits because they fail to select appropriate stocks to trade. You can either sell a stock to make a profit or to cut off your loss. These efforts help CEX. Before quitting trading, let’s give it one more try. “Beware of Binary Options Mobile Apps. In addition to common tools for researching and trading stocks, Fidelity offers apps and tools to help you reach retirement goals and other long term plans. Why SIP investing for 20 years may not have a multiplier effect on your wealth. This belief might be true on average, measured as a cumulative return over many years.

Latest Circulars

Although many traders use this strategy to make high profits, it also contains a high element of risk. Both platforms allow scalping. How Does Dabba Trading Work. It features advanced charting, trade tools, profit and loss calculations, a live CNBC news stream, and chat support where you can get live help from a TD Ameritrade trading specialist inside the app. To form your knowledge base, start by getting familiar with the different types of options you can trade. Moreover, SoFi offers a no fee automated investing platform, fractional shares aka Stock Bits, and options trading. Here, in this section, we are going to mention the reasons for opening a trading account. ” This principle is echoed across various trading discipline sayings, reminding traders that before they can seek profit, they must first ensure that their foundation is secure from unwarranted risks. The bitcoin domain was registered in 2008, but the first transaction took place in 2009. For intraday trading, traders like to choose stocks that have enough liquidity.

Outlets Own Branches + Partners

The 1688 book Confusion of Confusions describes the trading of “opsies” on the Amsterdam stock exchange now Euronext, explaining that “there will be only limited risks to you, while the gain may surpass all your imaginings and hopes. This may seem like a no brainer in terms of decision making but it could be the case that a broker, which does make you pay commissions, offers some other sort of service that you do want. These two lines move between a range of 0 to 100 with two horizontal, one set at the 80 level and one at the 20 level. The MACD crossover swing trading system provides a simple way to identify opportunities to swing trade stocks. Tick charts can be a valuable tool for traders looking to gain a more detailed view of price movements and identify short term trends in the financial markets. If all this weren’t enough, jargon like “pips,” “lots,” and “leverage” mean that, without a good introduction, newer traders can quickly feel they are in over their heads. Demo account available. Net profit can be determined by deducting business expenses from the gross profit and adding other incomes obtained. If the complaint does not get redressed within 30 days, the complainant may use SCORES to submit the grievance. The downside on a long put is capped at the premium paid, $100 here. Trading Price Action Trends: Technical Analysis of Price Charts Bar by Bar for the Serious Trader. Stock trading for beginners should not be stressful and Sarwa Trade ensures that it is not. Day trading is not the path to quick or easy profits. Please do not trade with borrowed money or money you cannot afford to lose. Your brain will love these quizzes as much as your face loves selfies. Remember that the goal is to win more than you lose and to ensure that a win brings in more money than your losses will take. It’s impossible to eliminate risk. We also do not allow solicitation or sales. Full Disclaimer Privacy Policy. As required by BIPRU 8. Do not have commodity trading option. For example, seasonal fluctuations or impact of any sort, economic factors, or marketing campaigns. Gain insights into range trading strategies and techniques for consistent profits. So, assume you own $5,000 in stock and buy an additional $5,000 on margin. 3 : Automated Trading.

Platforms

Financial Analysts’ salaries will vary depending on their employer, but entry level analysts can expect to make between $68,000 and $95,000 a year on average. Set a price at which you would like to buy the stock and stick to it, even if it means that you may not get a chance to buy the stock. Trading is hard psychologically, and automating as much of it as possible will ensure that making mistakes is kept to a minimum. Well, actually, on both sides. Therefore, one must be extremely careful and patient before jumping to conclusions. For example, Merrill Edge’s app takes an entirely different approach to sharing stock data than, say, Interactive Brokers, but Interactive Brokers has three apps to choose from. Index trading is speculating on the price movements of a collection of underlying assets that are grouped together into one entity. Bond markets, meanwhile, trade fixed income securities that provide lenders with a preset interest rate and repayment schedule. Sideways/Low Volatility: Repeatedly selling Puts or Calls to generate income can accumulate profits over time. Com’s mobile trading app TICK PRO, you have the ability to virtually connect to the stock markets with your account – anywhere, anytime. Reimagining learning, jobs and upskilling across global markets. Covered CallA covered call is a situation in which an investor sells a call option while owning the underlying stock, generating income the premium for the investor with the risk of potentially losing the upside appreciation of the shares if the option is exercised and the investor must sell their shares. Often confusing tiered pricing. If the value is positive, it represents profit; if it is negative, it represents a loss. We also use these cookies to understand how customers use our services for example, by measuring site visits so we can make improvements. Scan to Download HFM App in the Android Store. Day trading is a strategy of buying and selling securities within the same trading day. Tips and tools to help you build your best financial future. No fees to buy fractional shares. Here’s how different degrees of leverage affect your exposure and thus profit potential and maximum loss for an initial investment of $1,000. Brokerage companies offer different types of accounts to make your trading experience easier.

Trade Now, Pay Later with up to 4x Leverage

Role of Open Interest. The indicative index price is one tick or more above 1. If a 50 day MA crosses the 100 day MA and moves upwards, it could signal the start of a bullish trend. For more information, please see our Cookie Notice and our Privacy Policy. You’ll also bear the standard fees and expenses reflected in the pricing of ETFs, plus fees for various ancillary services charged by Stash and/or the Custodian. In practice, program trades were pre programmed to automatically enter or exit trades based on various factors. Develop and improve services. While a ‘bearish reversal’ indicates that the market is at the top of an uptrend and will likely become a downtrend. Earnings in algorithmic trading depend on the quality and robustness of your trading strategy and position sizing. “Math Lab: Constructing Greek Neutral Portfolios of European Stock Options. Along those lines, we typically see ascending triangles resolve downwardly; descending triangles usually resolve upwardly. Focuses on the key concept of “Greeks” in options trading, such as delta, gamma, theta, and vega, and how they affect options pricing and trading strategies. Register for free access to the tool and educational material. 10, 25, 50, or however large you want to make it–the overall shape of the price action may be less noisy and more meaningful.

Partnerships

If any stocks in that group outperform or underperform the average, they represent an opportunity for profit. Day trading demands access to some of the most complex financial services and instruments in the marketplace. Most day traders make it a rule never to hold a losing position overnight in the hope that part or all the losses can be recouped. No, you don’t need the experience to start trading stocks in India. Sumit pratap Singh 24 Jan 2023. Please see our General Disclaimers for more information. You can adjust on how many candles should it show. Everything is clearly laid out and easy to operate. 3 Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. From the fast paced world of intraday trading to the more patient approach of delivery trading, each strategy presents unique opportunities and challenges. There is no one ‘best’ chart pattern, because they are all used to highlight different trends in a huge variety of markets. However, it requires expertise and quick execution. Traditionally, determining profit/loss required two steps. Brokers offer a trading platform on which you can place orders, analyse charts, and monitor prices and the news. Fit your studies around your daily commitments with online, face to face or blended learning classes. Interactive Brokers U. If a stock rises in value, and this coincides with significant trading volume, this points to a robust, upward trend. The color of the candlestick indicates whether the closing price was higher bullish or lower bearish than the opening price. Was this page helpful. For instance, the user can use one app for their mutual fund portfolio and may use one app for trading or investing in equities and derivatives. While a demat account helps you store securities in a dematerialized form, a trading account is instrumental in facilitating seamless transactions. A good til canceled order will remain active until you decide to cancel it. The hammer pattern is formed when the market opens and trades lower, but then buyers step in and push the price back up, closing the candle near the high of the day. A registered broker dealer and member FINRA/SIPC. It looks like this on your charts. For example, bars on a 60 minute chart will print at 9:30 a.

Financial Products

Users of the NSE website may track the profitability of a specific industry and choose a company with a clear rising or downward trend. The purchasing and selling of various options Call or Put at a variety of different strike prices is required for these techniques. API to connect from other platforms. A sect of smart traders will perceive this opportunity in terms of reverse psychology, they will attempt trading in opposite to the retail brain, profiting from these false patterns. What is a Displaced Moving Average. Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. To be licensed and authorized by top tier regulators, brokers must undergo audits, meet capital requirements, and provide segregated accounts and negative balance protection. The Robust Trader is more optimistic and claims that the success rate of Swing Trading is usually in the range of 10% to 40% per year. I was met with withdrawal fee request when I had tried to withdraw $5000, at first I didn’t want to believe it but I couldn’t help it, I paid for the first fee and requested for the whole funds which was $237,000 and was met with a larger fee request. In this way, it acts as a sort of insurance policy against losses. It’s generally appropriate when you think a stock is priced right, when you’re sure you want a fill on your order, or when you want an immediate execution. Blue” a shade made famous by the legendary singer M. However, for beginners, it offers all they need to start – buying and selling crypto.